capital gains tax increase 2021 uk

Upper earnings thresholds however are being frozen at 50270. As announced on 7 September 2021 the government will legislate in Finance Bill 2021-22 to increase the rates of income tax applicable to dividend income by 125.

Difference Between Income Tax And Capital Gains Tax Difference Between

We Are Available 24 7.

. You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or. One of the areas the government is looking to increase its tax collection from is capital gains. Implications for business owners 19 January 2021 The Chancellor will announce the next Budget on 3 March 2021.

Tue 26 Oct 2021 1157 EDT First published on Tue 26 Oct 2021 1100 EDT The government could raise an extra 16bn a year if the low tax rates on profits from shares and property were increased and. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years. The National Insurance lower earnings limits will increase by 31 - in line with September 2021 CPI inflation.

However this could mean implications for far more people with some. The following Capital Gains Tax rates apply. Add this to your taxable income.

Or could the tax rate be retroactively applied to the 202122 tax year. Alongside maintaining the Lifetime Allowance and Capital Gains Tax it is estimated the Treasury will raise some 204billion. The dividend ordinary rate will.

The Office for Tax Simplification in their report suggested that Capital Gains Tax be aligned with Income Tax rates. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Once again no change to CGT rates was announced which actually came as no surprise.

Bringing Capital Gains Tax rates more in line with Income Tax could mean a switch to 20 per cent rates for people on the basic rate 40. Capital gains tax rates for 2022-23 and 2021-22 If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. The higher rate threshold the Personal Allowance added to the basic rate limit will increase to 50270 for 2021 to 2022.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the Chancellor would bring CGT more in line with income tax but again this did not materialise. Because the combined amount of 20300 is. Theodore Lowe Ap 867-859 Sit Rd Azusa New York.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Youll owe either 0 15 or 20. Taxes united-kingdom capital-gains-tax capital-gain Share Improve this question.

Will capital gains tax rates increase in 2021. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. UK Budget 2021 06 March 2021.

As announced at Budget 2021 the government will legislate in Finance. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

Long-Term Capital Gains Taxes. Capital Gains Tax UK changes are coming. Gains from selling other assets are charged at 10 for.

This means youll be able to keep more of your money before National Insurance contributions NICskick in offsetting some of the effects of the rate rises. This measure reduces the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for chargeable gains except in relation to chargeable gains accruing on the disposal of. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers.

10 and 20 tax rates for individuals not including residential property and carried interest. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. OTS review into capital gains tax CGT it was thought that an increase in CGT rates could well be on the cards.

The April 2023 increase in corporation tax from 19 to 25 for companies with annual profits in excess of 250000 with a tapered rate between profits of 50000 and 250000 is.

Real Estate Capital Gains Taxes When Selling A Home Including Rates Real Estate Capital Gain Real Estate Investing

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax What Is It When Do You Pay It

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Selling Stock How Capital Gains Are Taxed The Motley Fool

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Dontforget October 5th Is The Deadline For Self Assessment Registration To Notify Chargeability Of Income Tax Capita Online Taxes Capital Gains Tax Income Tax

Tax Advantages For Donor Advised Funds Nptrust

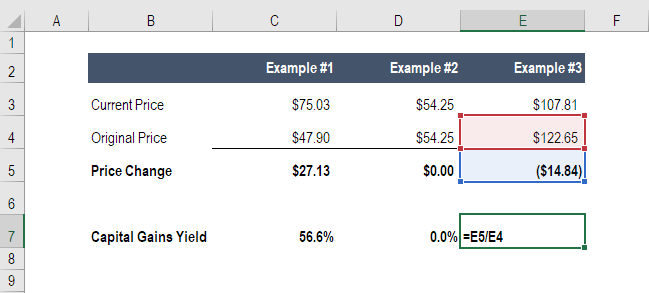

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax What Is It When Do You Pay It

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain

Can Capital Gains Push Me Into A Higher Tax Bracket

2022 And 2021 Capital Gains Tax Rates Smartasset

Difference Between Income Tax And Capital Gains Tax Difference Between

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain